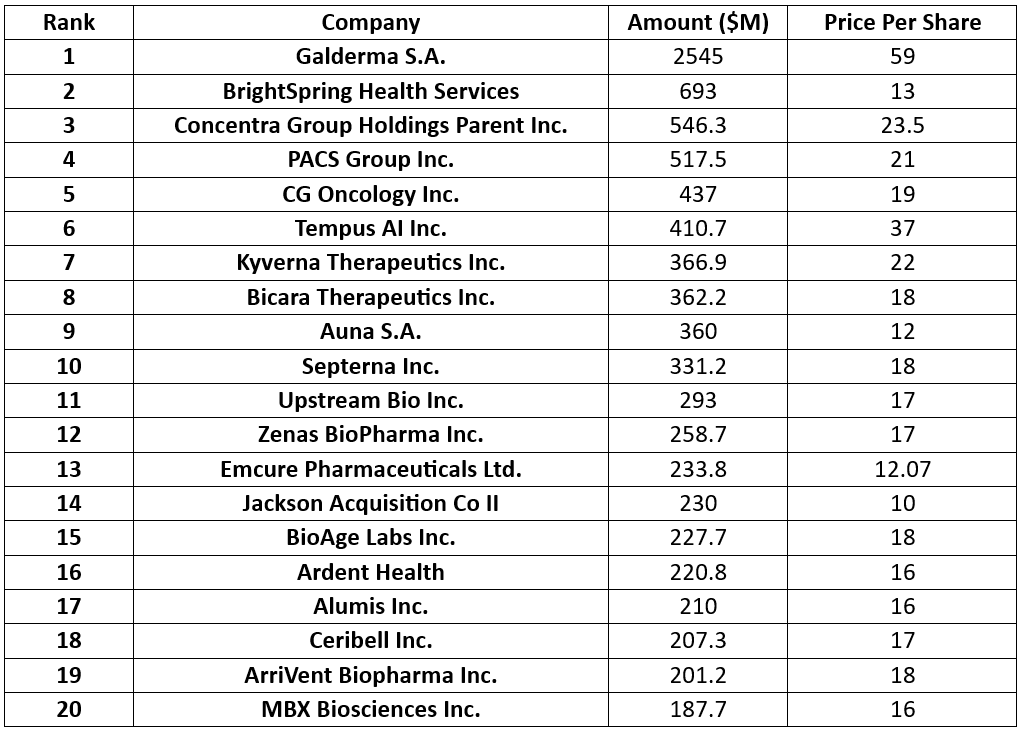

Top 20 Healthcare IPOs of 2024

Shots:

- Initial Public Offerings (IPOs) serve as a strategic avenue for private healthcare companies to enhance liquidity, secure capital, and strengthen market presence. Beyond fundraising, going public often paves the way for strategic partnerships and expanded industry influence.

- Galderma led the IPO landscape in 2024, raising a staggering $2.54B, followed by BrightSpring Health Services and Concentra Group, securing $0.69 billion and $0.54B, respectively.

- Backed by DealForma's insights, PharmaShots presents a comprehensive report on the Top 20 Healthcare IPOs of 2024, delivering key trends, funding details, and industry impact. Stay ahead with our expert analysis

Note: Columns 1 and 2 represent the rank and companies while Columns 3 and 4 represent the amount generated by the IPO launch and the price per share

20. MBX Biosciences

Funding Value: $187.7M

No. of Shares: 11.73M

Price Per Share: $16

IPO Announced Date: Aug 23, 2024

IPO Completion Date: Sep 12, 2024

Founded Year: 2018

Total Employees: 38

Headquarters: Indiana, United States

Stock Exchange: NASDAQ

- MBX Biosciences is a clinical-stage biopharmaceutical company focused on discovering and developing novel precision peptide therapies for endocrine and metabolic disorders

- Canvuparatide (MBX 2109) is the lead asset of MBX Biosciences being developed in P-II for Hypoparathyroidism

- The company generated a total of $187.7M with IPO in Sep 2024 by offering shares at $16 per share

19. ArriVent Biopharma

Funding Value: $201.2M

No. of Shares: 11.18M

Price Per Share: $18

IPO Announced Date: Jan 5, 2024

IPO Completion Date: Jan 25, 2024

Founded Year: 2021

Total Employees: 40

Headquarters: Pennsylvania, United States

Stock Exchange: NASDAQ

- ArriVent is a clinical-stage biopharmaceutical company focused on developing and commercializing differentiated medicines in oncology

- Firmonertinib is the lead asset of ArriVent and is being evaluated under P-III (FURVENT) for 1L NSCLC EGFR Exon 20 Insertion Mutations

- The company managed to generate a total of $201.2M with IPO in Jan 2024 by offering shares at $18 per share

18. Ceribell

Funding Value: $207.3M

No. of Shares: 12.19M

Price Per Share: $17

IPO Announced Date: Aug 26, 2024

IPO Completion Date: Oct 10, 2024

Founded Year: 2014

Total Employees: 240

Headquarters: California, United States

Stock Exchange: NASDAQ

- Ceribell is a commercial-stage medical technology company focused on the diagnosis and management of patients with neurological conditions

- Ceribell System is the company's lead asset, a point-of-care electroencephalography that uses artificial intelligence to diagnose and continuously monitor neurological patients

- The company generated a total of $207.3M with IPO in Aug 2024 by offering shares at $17 per share

17. Alumis

Funding Value: $210M

No. of Shares: 13.12M

Price Per Share: $16

IPO Announced Date: Jun 7, 2024

IPO Completion Date: Jun 27, 2024

Founded Year: 2021

Total Employees: 145

Headquarters: California, United States

Stock Exchange: NASDAQ

- Alumis is a clinical-stage biopharmaceutical company focusing on developing oral therapies for immune-mediated diseases

- ESK-001 is the lead asset of the company that is being evaluated in the P-III study for Psoriasis

- The company managed to pull in a total of $210M with IPO in Jun 2024 by offering shares at $16 per share

16. Ardent Health

Funding Value: $220.8M

No. of Shares: 13.8M

Price Per Share: $16

IPO Announced Date: Jun 21, 2024

IPO Completion Date: Jul 17, 2024

Founded Year: 2001

Total Employees: 21,400

Headquarters: Tennessee, United States

Stock Exchange: NASDAQ

- Ardent Health is a healthcare provider in midsize urban areas in the US. The organization is dedicated to investing in cutting-edge services and technologies

- Ardent Health provides services through its subsidiaries, operating a network of 30 acute care hospitals and over 200 care locations, with more than 1,700 healthcare providers spreading across six states

- The company managed to generate a total of $220.8M with an IPO in Jul 2024 by offering shares at $16 per share

15. BioAge Labs

Funding Value: $227.7M

No. of Shares: 12.65M

Price Per Share: $18

IPO Announced Date: Sep 3, 2024

IPO Completion Date: Sep 25, 2024

Founded Year: 2015

Total Employees: 59

Headquarters: California, United States

Stock Exchange: NASDAQ

- BioAge is a clinical-stage biopharmaceutical company focused on developing therapeutic product candidates for metabolic diseases

- Azelaprag, the company's lead asset, is currently being evaluated in P-II trials for obesity

- The company managed to collect a total of $227.7M with IPO in Sep 2024 by offering shares at $18 per share

14. Jackson Acquisition Co II

Funding Value: $230M

No. of Shares: 23M

Price Per Share: $10

IPO Announced Date: Sep 27, 2024

IPO Completion Date: Dec 12, 2024

Founded Year: 2024

Total Employees: N/A

Headquarters: Georgia, United States

Stock Exchange: NYSE

- Jackson Acquisition is a blank cheque company that targets private healthcare services companies for acquisition and public listing

- The company has still not announced a particular business combination nor has generated any revenue

- The company managed to pull in $230M with an IPO in Dec 2024 by offering shares at $10 per share

13. Emcure Pharmaceuticals Ltd.

Funding Value: $233.8M

No. of Shares: 19.36M

Price Per Share: $12.07

IPO Announced Date: Jul 3, 2024

IPO Completion Date: Jul 8, 2024

Founded Year: 1981

Total Employees: 10,852

Headquarters: Pune, India

Stock Exchange: NSE

- Emcure is an Indian biopharmaceutical company focused on developing and commercializing therapies for gynecology, cardiology, blood-related, oncology, respiratory, CNS & HIV

- Elaxim and Tenectase are some of the well-known products of the company

- The company raised a total of $233.8M with an IPO in Jul 2024 by offering shares at $12.07 per share

12. Zenas BioPharma Inc.

Funding Value: $258.7M

No. of Shares: 15.22M

Price Per Share: $17

IPO Announced Date: Aug 22, 2024

IPO Completion Date: Sep 12, 2024

Founded Year: 2019

Total Employees: 115

Headquarters: Massachusetts, United States

Stock Exchange: NASDAQ

- Zenas is a clinical-stage global biopharmaceutical company focused on developing and commercializing immunology-based therapies

- Zenas’ lead product candidate, obexelimab is currently in a P-III study for Immunoglobin G4-related Disease (IgG4-RD)

- The company managed to pull in a total of $258.7M with IPO in Sep 2024 by offering shares at $17 per share

11. Upstream Bio Inc.

Funding Value: $293M

No. of Shares: 17.25M

Price Per Share: $17

IPO Announced Date: Sep 18, 2024

IPO Completion Date: Oct 10, 2024

Founded Year: 2021

Total Employees: 38

Headquarters: Massachusetts, United States

Stock Exchange: NASDAQ

- Upstream Bio is a biopharmaceutical company focused on developing antibody-based therapeutics for inflammation and pulmonary diseases

- Verekitug (UPB-101) is the lead asset of the company that is being assessed in the P-II study in patients with severe asthma and 12 weeks for patients with CRSwNP

- The company generated a total of $293M with IPO in Oct 2024 by offering shares at $17 per share

10. Septerna

Funding Value: $331.2M

No. of Shares: 18.4M

Price Per Share: $18

IPO Announced Date: Sep 2, 2024

IPO Completion Date: Sep 24, 2024

Founded Year: 2019

Total Employees: 73

Headquarters: California, United States

Stock Exchange: NASDAQ

- Septerna is a biopharmaceutical company focused on developing therapeutics for endocrine, metabolic, neurologic, ophthalmic, and inflammation diseases using its proprietary Native Complex Platform

- SEP-631 (MRGPRX2) is the leading asset of Septerna which is in the early stage of development for immunology and inflammation

- The company generated a total of $331.2M with IPO in Sep 2024 by offering shares at $18 per share

9. Auna S.A.

Funding Value: $360M

No. of Shares: 30M

Price Per Share: $12

IPO Announced Date: Jan 9, 2024

IPO Completion Date: Mar 21, 2024

Founded Year: 1989

Total Employees: 14,846

Headquarters: Lima, Peru

Stock Exchange: NYSE

- Auna provides healthcare services in Spanish-speaking Latin America, including clinics, wellness centers, and insurance for cancer patients

- Auna employs a patient-centric model to offer an accessible and integrated healthcare experience using its regional network of hospitals, clinics, and healthcare plans

- The company managed to generate a total of $360M with an IPO in Mar 2024 by offering shares at $12 per share

8. Bicara Therapeutics

Funding Value: $362.2M

No. of Shares: 20.12M

Price Per Share: $18

IPO Announced Date: Aug 8, 2024

IPO Completion Date: Sep 12, 2024

Founded Year: 2018

Total Employees: 32

Headquarters: Massachusetts, United States

Stock Exchange: NASDAQ

- Bicara Therapeutics is a biopharmaceutical company focused on developing antibodies for cancer. In 2023, Biocon spun out Bicara Therapeutics

- Ficerafusp alfa (BCA101), the company's lead asset, is currently being studied in 1L HPV-Recurrent/Metastatic Head and Neck Squamous Cell Carcinoma (HNSCC)

- Bicara generated a total of $362.2M with IPO in Sep 2024 by offering shares at $18 per share

7. Kyverna Therapeutics

Funding Value: $366.9M

No. of Shares: 16.67M

Price Per Share: $12

IPO Announced Date: Jan 16, 2024

IPO Completion Date: Feb 7, 2024

Founded Year: 2018

Total Employees: 119

Headquarters: California, United States

Stock Exchange: NASDAQ

- Kyverna is a clinical-stage biopharmaceutical company focused on developing cell therapies for autoimmune diseases

- KYV-101 is the lead asset of Kyverna Therapeutics that is currently under the P-II study for stiff person syndrome and myasthenia gravis

- The company raised a total of $366.9M with IPO in Feb 2024 by offering shares at $12 per share.

6. Tempus AI Inc.

Funding Value: $410.7M

No. of Shares: 11.1M

Price Per Share: $37

IPO Announced Date: May 20, 2024

IPO Completion Date: Jun 13, 2024

Founded Year: 2015

Total Employees: 2,300

Headquarters: Illinois, United States

Stock Exchange: NASDAQ

- Tempus is a health tech company focused on developing precision medicine leveraging its AI system

- Tempus offers AI-driven precision medicine solutions to physicians for personalized patient care while also supporting the discovery, development, and delivery of optimal therapeutics

- The IPO ended up pulling in $410.7M in Jun 2024 by offering shares at $37 per share

5. CG Oncology

Funding Value: $437M

No. of Shares: 23M

Price Per Share: $19

IPO Announced Date: Jan 2, 2024

IPO Completion Date: Jan 24, 2024

Founded Year: 2010

Total Employees: 61

Headquarters: California, United States

Stock Exchange: NASDAQ

- CG Oncology is a late-stage clinical biopharmaceutical company focused on developing and commercializing therapeutics for bladder cancer

- Cretostimogene grenadenorepvec is the lead asset of the company that is currently being evaluated in two P-III studies for BCG unresponsive, Intermediate-Risk, and MIBC

- The company raised $437M through IPO in Jan 2024 by offering shares at $19 per share

4. PACS Group

Funding Value: $517.5M

No. of Shares: 24.64M

Price Per Share: $21

IPO Announced Date: Mar 13, 2024

IPO Completion Date: Apr 10, 2024

Founded Year: 2013

Total Employees: 32,433

Headquarters: Utah, United States

Stock Exchange: NYSE

- PACS offers post-acute healthcare facilities, professionals, and ancillary services through its subsidiaries

- PACS Group subsidiaries comprise a fast-growing national platform investing in post-acute care facilities, senior living communities, and related professionals and auxiliary services

- The company ended up raising $517.5M through IPO in Apr 2024 by offering shares at $21 per share

3. Concentra Group Holdings Parent

Funding Value: $546.3M

No. of Shares: 23.25M

Price Per Share: $23.5

IPO Announced Date: Jun 14, 2024

IPO Completion Date: Jul 24, 2024

Founded Year: 1979

Total Employees: 8,960

Headquarters: Texas, United States

Stock Exchange: NYSE

- Concentra is a service company focused on providing occupational health services to employers and patients, including urgent care, occupational medicine, physical therapy, primary care, and wellness programs

- Currently, Concentra has 547 occupational health centers in 41 states and 154 onsite health clinics at employer worksites in 37 states

- The company managed to raise a total of $517.5M with IPO in Apr 2024 by offering shares at $21 per share

2. BrightSpring Health Services

Funding Value: $693M

No. of Shares: 53.33M

Price Per Share: $13

IPO Announced Date: Jan 2, 2024

IPO Completion Date: Jan 25, 2024

Founded Year: 1974

Total Employees: 35,000

Headquarters: Kentucky, United States

Stock Exchange: NASDAQ

- BrightSpring Health Services is a service company focused on providing complimentary home and community-based healthcare services to elderly and disabled people

- The company has 900+ locations across all service lines and holds accreditation from leading third-party national accrediting bodies

- The company managed to raise a total of $693M with IPO in Jan 2024 by offering shares at $13 per share

1. Galderma S.A.

Funding Value: $2545M

No. of Shares: 43.13M

Price Per Share: $59

IPO Announced Date: Mar 13, 2024

IPO Completion Date: Mar 22, 2024

Founded Year: 1981

Total Employees: 6,545

Headquarters: Lausanne, Switzerland

Stock Exchange: SWX

- Galderma focuses on developing and commercializing topical formulations for the treatment of dermatological diseases

- Cetaphil and Alastin are among the well-known products of Galderma

- The IPO ended up raising $2545M in Mar 2024 by offering shares at $59 per share

Sources:

- Press releases

- OANDA

- Company Websites

Related Post: Top 20 IPOs in Healthcare by Total Fund Value 2023

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.